Archive for the ‘Economics’ Category

Back Story

Back Story

E-mail of the month:

To All My Valued Employees,

There have been some rumblings around the office about the future of this company, and more specifically, your job. As you know, the economy has changed for the worse and presents many challenges. However, the good news is this: The economy doesn’t pose a threat to your job. What does threaten your job however, is the changing political landscape in this country.

However, let me tell you some little tidbits of fact which might help you decide what is in your best interests.

First, while it is easy to spew rhetoric that casts employers against employees, you have to understand that for every business owner there is a back story. This back story is often neglected and overshadowed by what you see and hear. Sure, you see me park my Mercedes outside. You’ve seen my big home at last year at a Christmas party. I’m sure; all these flashy icons of luxury conjure up some idealized thoughts about my life.

However, what you don’t see is the back story.

I started this company 28 years ago. At that time, I lived in a 300 square foot studio apartment for 3 years. My entire living apartment was converted into an office so I could put forth 100% effort into building a company, which by the way, would eventually employ you.

My diet consisted of Ramen Pride noodles because every dollar I spent went back into this company. I drove a rusty Toyota Corolla with a defective transmission. I didn’t have time to date. Often times, I stayed home on weekends, while my friends went out drinking and partying. In fact, I was married to my business — hard work, discipline, and sacrifice.

Meanwhile, my friends got jobs. They worked 40 hours a week and made a modest $50K a year and spent every dime they earned. They drove flashy cars and lived in expensive homes and wore fancy designer clothes. Instead of hitting the Nordstrom’s for the latest hot fashion item, I was trolling through the discount store extracting any clothing item that didn’t look like it was birthed in the 70’s. My friends refinanced their mortgages and lived a life of luxury. I, however, did not. I put my time, my money, and my life into a business with a vision that eventually, some day, I too, will be able to afford these luxuries my friends supposedly had.

So, while you physically arrive at the office at 9am, mentally check in at about noon, and then leave at 5pm, I don’t. There is no “off†button for me. When you leave the office, you are done and you have a weekend all to yourself. I unfortunately do not have the freedom. I eat, and breathe this company every minute of the day. There is no rest. There is no weekend. There is no happy hour. Every day this business is attached to my hip like a 1 year old special-needs child. You, of course, only see the fruits of that garden — the nice house, the Mercedes, the vacations… you never realize the back story and the sacrifices I’ve made.

Now, the economy is falling apart and I, the guy that made all the right decisions and saved his money, have to bail-out all the people who didn’t. The people that overspent their paychecks suddenly feel entitled to the same luxuries that I earned and sacrificed a decade of my life for.

Yes, business ownership has is benefits but the price I’ve paid is steep and not without wounds.

Unfortunately, the cost of running this business, and employing you, is starting to eclipse the threshold of marginal benefit and let me tell you why:

I am being taxed to death and the government thinks I don’t pay enough. I have state taxes. Federal taxes. Property taxes. Sales and use taxes. Payroll taxes. Workers compensation taxes. Unemployment taxes. Taxes on taxes. I have to hire a tax man to manage all these taxes and then guess what? I have to pay taxes for employing him. Government mandates and regulations and all the accounting that goes with it, now occupy most of my time. On Oct 15th, I wrote a check to the US Treasury for $288,000 for quarterly taxes. You know what my “stimulus†check was? Zero. Nada. Zilch.

The question I have is this: Who is stimulating the economy? Me, the guy who has provided 14 people good paying jobs and serves over 2,200,000 people per year with a flourishing business? Or, the single mother sitting at home pregnant with her fourth child waiting for her next welfare check? Obviously, government feels the latter is the economic stimulus of this country.

The fact is, if I deducted (Read: Stole) 50% of your paycheck you’d quit and you wouldn’t work here. I mean, why should you? That’s nuts. Who wants to get rewarded only 50% of their hard work? Well, I agree which is why your job is in jeopardy.

Here is what many of you don’t understand … to stimulate the economy you need to stimulate what runs the economy. Had suddenly government mandated to me that I didn’t need to pay taxes, guess what? Instead of depositing that $288,000 into the Washington black-hole, I would have spent it, hired more employees, and generated substantial economic growth. My employees would have enjoyed the wealth of that tax cut in the form of promotions and better salaries. But you can forget it now.

When you have a comatose man on the verge of death, you don’t defibrillate and shock his thumb thinking that will bring him back to life, do you? Or, do you defibrillate his heart? Business is at the heart of America and always has been. To restart it, you must stimulate it, not kill it. Suddenly, the power brokers in Washington believe the poor of America are the essential drivers of the American economic engine. Nothing could be further from the truth and this is the type of change you can believe in. So where am I going with all this?

It’s quite simple.

If any new taxes are levied on me, or my company, my reaction will be swift and simple. I fire you. I fire your co-workers. You can then plead with the government to pay for your mortgage, your SUV, and your child’s future. Frankly, it isn’t my problem anymore.

Then, I will close this company down, move to another country, and retire. You see, I’m done. I’m done with a country that penalizes the productive and gives to the unproductive. My motivation to work and to provide jobs will be destroyed, and with it, will be my citizenship.

So, if you lose your job, it won’t be at the hands of the economy; it will be at the hands of a political hurricane that swept through this country, steamrolled the constitution, and will have changed its landscape forever. If that happens, you can find me sitting on a beach, retired, and with no employees to worry about.

Signed, Your Boss

Atlas is definitely shrugging. I’d love to meet this anonymous producer who has had enough. I first sold my business with sixteen employees and retired at the age of 45 for similar reasons. I would only add the hassle of dealing with employees who have been programed to think they have a right to a job on their terms. Only a drastic change in my personal life circumstances, ever allowed me to break my promise to myself to never have another employee. â—„Daveâ–º

Another Prescient Book

Another Prescient Book

I just read chapter one of a book that was written a year ago, before all of the financial shenanigans last fall. “Entitled The Collapse of the Dollar and How to Profit From It,” it was prescient indeed:

But as the century ended, so did this extraordinary run. Tech stocks crashed, the Twin Towers fell, and Americans’ sense of omnipotence went the way of their nest eggs. As this is written in early 2008, three million fewer Americans are drawing paychecks. The federal government is borrowing $500 billion each year to finance the war on terror as well as an array of new or expanded social programs, and many parts of the financial system, including sub-prime mortgages, credit insurance, and municipal bonds, seem to be imploding.

The dollar, meanwhile, has become the world’s problem currency, falling in value versus other major currencies and plunging versus gold. The whole world is watching, scratching its collective head, and wondering what has changed. The answer, as will become clear in the next few chapters, is that everything has changed, and nothing has. The spectacular growth of the past two decades, it now turns out, was a mirage generated by the smoke and mirrors of rising debt and the willingness of the rest of the world to accept a flood of new dollars. Just how much the U.S. owes will shock you. But even more shocking is the fact that we’re still at it. Like a family that has maintained its lifestyle by maxing out a series of credit cards, America is at the point where new debt goes to pay off the old rather than to create new wealth. Hence the past few years’ slow growth and steady loss of jobs.

So why say that nothing has changed? Because today’s problems are new only in terms of recent U.S. history. A quick scan of world history reveals them to be depressingly familiar. All great societies pass this way eventually, running up unsustainable debts and printing (or minting) currency in an increasingly desperate attempt to maintain the illusion of prosperity. And all, eventually, find themselves between the proverbial devil and deep blue sea: Either they simply collapse under the weight of their accumulated debt, as did the U.S. and Europe in the 1930s, or they keep running the printing presses until their currencies become worthless and their economies fall into chaos.

This time around, governments the world over have clearly chosen the second option. They’re cutting interest rates, boosting spending, and encouraging the use of modern financial engineering techniques to create a tidal wave of credit. And history teaches that once in motion, this process leads to an inevitable result: Fiat (i.e., government-controlled) currencies will become ever less valuable, until most of us just give upon them altogether. These are strong words, we know. But by the time you’ve finished the next two chapters we think you’ll agree that they are, unfortunately, quite accurate.

I bet a whole lot of folks wish they had read and heeded this book before last fall. The key word is “heeded.” I was saying similar things on another forum last summer and nobody wanted to hear it, much less act on it. I am the only one I know who has not lost a dime during recent events. â—„Daveâ–º

Immigration Impact on Infrastructure

Immigration Impact on Infrastructure

Perhaps I just answered my own question in the last post. I stumbled across a mind blowing report in The Social Contract extensively documenting the cost of the unprecedented growth we are experiencing because of illegal immigration. Entitled, “The Twin Crises: Immigration and Infrastructure,” by Edwin S. Rubenstein, it is a beautifully formatted, fact and reference filled, 87 page PDF file that deserves to be widely read. To encourage you to do so, here is the introduction:

This article highlights the role of immiÂgration in depreciating and driving up the cost of maintaining, improving, and expanding infrastructure in the U.S. Fifteen different categories of public infrastructure are covered:

- airports

- bridges

- dams

- drinking water

- energy (national power grid)

- hazardous waste

- hospitals

- navigable waterways

- public parks and recreation

- public schools

- railroads

- border security

- solid waste

- mass transit

- water and sewer systems.

Infrastructure and immigration? That’s an odd couple. Immigration policy has been deÂbated for years, but the debate usually focuses on border security, amnesty, and whether ilÂlegal alien workers are really needed to do the jobs that Americans “won’t do.â€

Immigration’s impact on public infraÂstructure is rarely discussed.

Until the past few months, infrastructure policy was itself on the back burner, surfacÂing only when a bridge or levee collapsed, but generally of interest only to civil engineers and policy wonks.

How things change! Today, infrastructure spending is widely seen as a key lifeline for a sinking economy. The lion’s share of PresÂident-elect Obama’s stimulus package will fund road and mass transit projects, school construction, port expansions, and alternative energy projects.

Yes, our infrastructure is in trouble. The American Society of Civil Engineers’ 2005 Report Card assigned an overall grade of D to the 15 infrastructure categories. Grades were selected on the basis of physical condition and capacity following a traditional grading scale (for example, if 77 percent of our roads are in good condition or better, the roads would be given a grade of C).

But if money were the problem, there would be no problem. Since 1982, capital spending on public infrastructure has inÂcreased by 2.1 percent per year above the inflation rate. Over this period, governments have spent $3.1 trillion (in today’s dollars) to build transportation infrastructure, and anÂother $3.8 trillion to maintain and operate it. Last year, we spent 50 percent more, after adÂjusting for inflation, on highway construction than we did a quarter of a century ago. Yet over this period, highway miles increased by only 6 percent, while U.S. population grew by 31 percent—half of it due to immigration.

The “demand†for highway infrastrucÂture, as measured by population growth, grew six times faster than the “supply†of highway infrastructure.

Bottom line: Our infrastructure is “crumÂbling†because population growth has overÂwhelmed the ability of government to producÂtively spend the vast sums it already devotes to infrastructure.

All types of infrastructure are under stress because of immigration.

Public schools are a prime example. Although immigrants account for about 13 percent of the U.S. population, they are 21 percent of the school-age population. In California, a whopping 47 percent of the school-age population consists of immigrants or the children of immigrants. Some Los Angeles schools are so crowded that they have lengthened the time between classes to give students time to make their way through crowded halls. Los Angeles’ school construcÂtion program is so massive that the Army Corps of Engineers was called in to manage it.

This is a boom time for hospital construcÂtion. Sixty percent of hospitals are either building new facilities or planning to do so. But we have a two-tier hospital system in the U.S. Hospitals in poor areas—that serve primarily uninsured immigrants and Medicaid patients—cannot afford to upgrade their facilities. The uncompensated costs are killing them. In California, 60 emergency departments (EDs) have closed to avoid the uncompensated costs of their largely illegal alien caseloads.

Immigrants may not use any more water than other people. But they disproÂportionately settle in parts of the country where water is in short supply—and their sheer numbers have overwhelmed conservaÂtion efforts. Cities like San Antonio, El Paso, and Phoenix could run out of water in 10 to 20 years. San Diego’s water company has resorted to a once-unthinkable option: recyÂcling toilet water for drinking.

National parks along the southern border are scarred by thousands of unauthorÂized roads and paths used by illegal aliens crossing into the U.S. Their fires, trash, and vandalism have despoiled thousands of acres of pristine parkland.

The traditional response to these probÂlems was to throw more federal, state, and local tax money into infrastructure. When public support falters, infrastructure users are usually hit with higher tolls, higher transit fares, higher water bills, and other usage-reÂlated fees. As a last resort, many governments sell or lease entire highways, water systems, parks, and other infrastructure systems to private companies.

There is no end to the financial chicanery that infrastructure junkies will employ to support their habit. Wall Street veteran Felix Rohatyn recently proposed this “novel soluÂtion†to the problem:

Although private investors have successfully built new roads in places such as Poland and Spain, they have not done so extenÂsively in the U.S. But a National Infrastructure Bank could rediÂrect private efforts away from refinancing old facilities—as in the case of Chicago’s Skyway—to building new ones.

According to our plan, most of the funds the federal government now spends on existing proÂgrams (along with many of those program’s experts and facilities) would be transferred to the bank, which could not only finance the projects but also resell the loans it makes to investors in capital markets, much as other assets are rebundled for investors. The receipts from these sales would allow a new round of lending, giving the bank an impact far in excess of its initial capitalization.

That is no solution; it is a recipe for anÂother debacle a la sub-prime mortgages.

The prognosis is not good. In August 2008 the Census Bureau projected that U.S. population will be 433 million in 2050—an increase of 135 million, or 44 percent, from current levels. Eighty-two percent of the inÂcrease will be from new immigrants and their U.S.-born children.

The brutal reality is that no conceivable infrastructure program can keep pace with that kind of population growth. The tradiÂtional “supply-side†response to America’s infrastructure shortage—build, build, build—is dead, dead, dead. Demand reduction is the only viable way to close the gap between the supply and demand of public infrastructure.

Immigration reduction must play a role.

Each of the subject areas are then covered in frightening detail. When one adds this infrastructure dimension to the malaise our economy is in, and realizes that the politicians in DC have no intention of tackling the illegal immigration debacle, for the same political reason they can’t address the coming SSI/Medicare entitlement disaster, there really is little hope for our future as a prosperous nation.

We lived in the best of times, folks. It is all downhill from here. Sorry, kids, our generation blew your future already by continuing to elect Progressive politicians who pandered to our foolish need to feel good and compassionate. â—„Daveâ–º

Buy a House – Get a Green Card

Buy a House – Get a Green Card

Not surprisingly, Michelle Malkin has her knickers in a twist over this, and without thinking about it I would too; but I think there may be merit to the idea. The proximate trigger for our current economic meltdown was the bursting of the housing bubble. At this point, most of the “toxic” assets plaguing lenders is nonperforming real estate mortgages, because people are walking away from those that are upside down.

I have heard that there are over a million houses on the market with no buyers. A classic oversupply that has deflated the value of everyone’s real estate holdings. Meanwhile, we are supposedly permitting the mass migration of illegal alien peasants from Mexico because there are jobs American ghetto dwellers won’t get off their shiftless butts to do. Let’s kill two birds with one stone.

The program described in Michelle’s article is a typical governmental disaster; but what if we offered a green card to anyone with a clean record who would buy outright, with cash, any home for sale in America for the next year. We could also require them to deposit another $100K or more in an American bank to insure they had the capital to get started off on the right foot in their new life in America.

I would have infinitely less heartburn over entrepreneurial immigrants, who could pay their own way, not become a burden to our ever burgeoning welfare roles and social services, and are more likely to wish to assimilate into our native culture. Meanwhile, it would infuse our economy with a half of a trillion dollars of real cash, instead of taxpayers buying these assets; and property prices would go back up instead of continuing to crumble. Where am I going wrong here?

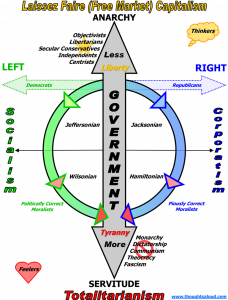

Capitalism Basics

Capitalism Basics

A mental midget blathered the following inanity at the end of our Ayn Rand discussion today:

There are two massive problems with Ayn Rand. First, her philosophy is ludicrous. She claims to believe only in what can be rationally observed and proven; yet she herself willingly consents to completely irrational ideas while refusing to admit as much. For instance, money is a fundamentally irrational phenomenon. Money has no intrinsic value, nor any objective existence; its a consensual illusion for the sake of an ordered society. In other words, its a leap of faith. This doesn’t even occur to Rand. Nothing is more ludicrous, for instance, than the fetishization of gold in Atlas Shrugged. Gold is a completely useless substance in and of itself, its only value is what is given to it by humans – on no rational basis at all – and then consented to by others. On this level, capitalism for Rand is clearly a religion: a delusion accepted for practical purposes, i.e. a noble lie.

Then he went on to discuss her literary failings. I couldn’t resist the following reply:

What twaddle. “Irrational†is not a synonym for “abstract.†“Money†is simply the abstract term we use for a useful medium of exchange among traders and temporary storage of disposable wealth. If I trade one of my excess perishable oranges to a neighbor for 20 steel nails, because I know another neighbor will gladly trade me one of his excess apples for fifteen nails next fall, the nails serve as “money†for all three of us.

There is nothing irrational about us agreeing to this arrangement, and there is nothing phenomenal about the nails to a rational man who owns a hammer. They have intrinsic value as a building supply, even though we also choose to use them for money. The apple grower has the choice to use them as nails to hang up his winter shutters, or save them as money he can trade for something else he will need in the spring; an option he would not have had with rotting apples.

Now, absent meddlesome neighbors trying to interfere in our mutually beneficial and unregulated commerce, there is nothing prohibiting me from agreeing to wait for payment from the first neighbor, if he agrees to pay me an extra nail or two in “interest†for the time he retains my “capital.†Conversely, I could offer to advance my “capital†to the apple grower, at a nail or two less than his asking price, for the promise of an apple when his crop comes in; a deal that he might jump at if he has an immediate need and is short of capital.

Thus capitalism is born, is entirely rational, and all participants eagerly enter into the exchanges and contracts with open eyes. Nobody is harmed or cheated, because we each trade something we value less, for something we value more. I, as the much maligned “capitalist,†am the only one who takes risks (that I will get paid eventually for my “loansâ€); but I am paid for taking them. If the other neighbors keep their “hands off†and continue not to meddle in our private affairs, we can call it laissez faire capitalism.

All manner of durable commodities have been used as money in human history, but silver and gold have been the favorites; because of their scarcity, and thus their high value for small, easily transportable, quantities. Contrary to your assertion, gold has intrinsic value, exists objectively, and is not illusory. I’ll not deny that some may have a fetish for gold; but that only enhances its intrinsic value, and insures that it will always be easy to trade a quantity of it for something one values more. This makes it an ideal commodity to use for money.

Objectively, nothing has “value†other than that assigned to it by a human mind, whether rationally or not. To the trader, it matters not how a seller determined his asking price. The buyer only has to decide if he personally values the offering more than what he must give up in trade for it. If he does, both win in the deal; if not, no deal is made. Thus, there are no losers in pure free trade. The only way to lose in capitalism is to invest capital at risk, and no one is required to do so.

There are rewards for risking capital; but rational actors choose for themselves whether the rewards outweigh the risks. There is simply nothing metaphysical or delusional about money or capitalism. It is pretty simple and really only common sense among producers and traders. It is an elegant system for reasonable men engaged in commerce. Those who oppose it are immediately suspect; for chances are that they wish to attain unearned produce, by enslaving the producers, one way or another, to provide them. â—„Daveâ–º

Atlas Shrugging

Atlas Shrugging

I have been saying for some time that if one has not reread Atlas Shrugged as an adult in the past few years, it is worth doing just to notice how prophetic she was. This morning in the WSJ, Stephen Moore has a column entitled, ” ‘Atlas Shrugged’: From Fiction to Fact in 52 Years“:

For the uninitiated, the moral of the story is simply this: Politicians invariably respond to crises — that in most cases they themselves created — by spawning new government programs, laws and regulations. These, in turn, generate more havoc and poverty, which inspires the politicians to create more programs . . . and the downward spiral repeats itself until the productive sectors of the economy collapse under the collective weight of taxes and other burdens imposed in the name of fairness, equality and do-goodism.

In the book, these relentless wealth redistributionists and their programs are disparaged as “the looters and their laws.” Every new act of government futility and stupidity carries with it a benevolent-sounding title. These include the “Anti-Greed Act” to redistribute income (sounds like Charlie Rangel’s promises soak-the-rich tax bill) and the “Equalization of Opportunity Act” to prevent people from starting more than one business (to give other people a chance). My personal favorite, the “Anti Dog-Eat-Dog Act,” aims to restrict cut-throat competition between firms and thus slow the wave of business bankruptcies. Why didn’t Hank Paulson think of that?

These acts and edicts sound farcical, yes, but no more so than the actual events in Washington, circa 2008. We already have been served up the $700 billion “Emergency Economic Stabilization Act” and the “Auto Industry Financing and Restructuring Act.” Now that Barack Obama is in town, he will soon sign into law with great urgency the “American Recovery and Reinvestment Plan.” This latest Hail Mary pass will increase the federal budget (which has already expanded by $1.5 trillion in eight years under George Bush) by an additional $1 trillion — in roughly his first 100 days in office.

The current economic strategy is right out of “Atlas Shrugged”: The more incompetent you are in business, the more handouts the politicians will bestow on you. That’s the justification for the $2 trillion of subsidies doled out already to keep afloat distressed insurance companies, banks, Wall Street investment houses, and auto companies — while standing next in line for their share of the booty are real-estate developers, the steel industry, chemical companies, airlines, ethanol producers, construction firms and even catfish farmers. With each successive bailout to “calm the markets,” another trillion of national wealth is subsequently lost. Yet, as “Atlas” grimly foretold, we now treat the incompetent who wreck their companies as victims, while those resourceful business owners who manage to make a profit are portrayed as recipients of illegitimate “windfalls.”

Indeed. Life continues to imitate art; and the clueless altruists continue to snidely denigrate those of us who subscribe to Ayn Rand’s philosophy. Too bad there is no John Galt they can turn to in the end… they wouldn’t listen to him anyway. â—„Daveâ–º

Understanding Central Banks

Understanding Central Banks

Do check out the video on Steel Phoenix’s latest post at “What is the Ideal Value of the Dollar in Today’s world?” It would be a shame to miss it. â—„Daveâ–º

New Capitalism?

New Capitalism?

While America’s news organizations are salivating over Obama’s big speech promising that we will “spend” our way out of this, who is paying attention to what the Europeans are busy doing today? Take a peek at “Sarkozy, Merkel, Blair call for new capitalism“:

PARIS – The head of Europe’s biggest economy said Thursday that world leaders should be looking at the massive U.S. deficit and other economic imbalances, not just problems caused by financial markets, as they debate a new global order…

Merkel said the International Monetary Fund has not managed to regulate global capitalism, and she called for the creation of an economy body at the United Nations, similar to the Security Council, to judge government policy.

French President Nicolas Sarkozy, …called financial capitalism based on speculation “an immoral system” that has “perverted the logic of capitalism.”

“It’s a system where wealth goes to the wealthy, where work is devalued, where production is devalued, where entrepreneurial spirit is devalued,” he said.

But no more: “In capitalism of the 21st century, there is room for the state,” he said…

Measures will be taken by global leaders meeting in London on April 2, Sarkozy promised, urging the U.S. to join the international consensus.

Blair called for a new financial order based on “values other than the maximum short-term profit.”

(bold emphasis mine)

Be afraid. Be very very afraid. The Obamessiah will be all for this globaloney. The timing of his speech today may have very well been to keep our press busy and this global agenda out of the news. â—„Daveâ–º

Rare Sagacity

Rare Sagacity

In a thread entitled, “Who is pro-science, the Left or the Right?” on the Secular Right blog, I have encountered a 71 year-old sage, who has made several profound comments that are well worth reading. “Gene Berman” does not have his own blog; but he should, for his perspective deserves a wider audience. He prefers to comment at places where he finds people actually thinking. It is a long thread, so skip the other comments if you like, but treat yourself to the thought that will be provoked by reading his. â—„Daveâ–º

Divided States of America

Divided States of America

I posted about Prof. Panarin’s prediction a month ago: “Russia Gets It!” Now there is a WSJ Article about it:

“There’s a 55-45% chance right now that disintegration will occur,” he says. “One could rejoice in that process,” he adds, poker-faced. “But if we’re talking reasonably, it’s not the best scenario — for Russia.” Though Russia would become more powerful on the global stage, he says, its economy would suffer because it currently depends heavily on the dollar and on trade with the U.S.

Mr. Panarin posits, in brief, that mass immigration, economic decline, and moral degradation will trigger a civil war next fall and the collapse of the dollar. Around the end of June 2010, or early July, he says, the U.S. will break into six pieces — with Alaska reverting to Russian control.

While the article makes it clear that a lot of people don’t take him seriously, his credentials and access to data are sobering. So is his map:

I certainly don’t agree with his predicted territories, and I suspect Sarah Palin isn’t going to give up Alaska to Russia without a fight; but the notion of a breakup during the coming depression is sounding less nutty all the time. Another telling quote:

Interest in his forecast revived this fall when he published an article in Izvestia, one of Russia’s biggest national dailies. In it, he reiterated his theory, called U.S. foreign debt “a pyramid scheme,” and predicted China and Russia would usurp Washington’s role as a global financial regulator.

Americans hope President-elect Barack Obama “can work miracles,” he wrote. “But when spring comes, it will be clear that there are no miracles.”

A Ponzi scheme has never been saved by a miracle… â—„Daveâ–º

Global Hopenchange

Global Hopenchange

In the Financial Times a couple of weeks ago was a sobering article entitled, “And now for a world government.”:

Barack Obama, America’s president-in-waiting, does not share the Bush administration’s disdain for international agreements and treaties. In his book, The Audacity of Hope, he argued that: “When the world’s sole superpower willingly restrains its power and abides by internationally agreed-upon standards of conduct, it sends a message that these are rules worth following.†The importance that Mr Obama attaches to the UN is shown by the fact that he has appointed Susan Rice, one of his closest aides, as America’s ambassador to the UN, and given her a seat in the cabinet.

A taste of the ideas doing the rounds in Obama circles is offered by a recent report from the Managing Global Insecurity project, whose small US advisory group includes John Podesta, the man heading Mr Obama’s transition team and Strobe Talbott, the president of the Brookings Institution, from which Ms Rice has just emerged.

The MGI report argues for the creation of a UN high commissioner for counter-terrorist activity, a legally binding climate-change agreement negotiated under the auspices of the UN and the creation of a 50,000-strong UN peacekeeping force. Once countries had pledged troops to this reserve army, the UN would have first call upon them.

These are the kind of ideas that get people reaching for their rifles in America’s talk-radio heartland. Aware of the political sensitivity of its ideas, the MGI report opts for soothing language. It emphasises the need for American leadership and uses the term, “responsible sovereignty†– when calling for international co-operation – rather than the more radical-sounding phrase favoured in Europe, “shared sovereigntyâ€. It also talks about “global governance†rather than world government.

Susan Rice; John Podesta; Strobe Talbott; any of those names sound familiar? Elections have consequences, and those celebrating the coming era of “Hopenchange” have no earthly idea what they have wrought. â—„Daveâ–º

Adventures For Pay

Adventures For Pay

Bloggers are starting to post their life’s job history, and some of them are interesting. I first encountered it at American Digest, and traced the meme back to one called Stageleft:

The most interesting things about blogging is the bloggers. I’ve only ever met four of you out there in the real world, but in some ways I think of many of you as friends.

But I don’t know very much about anyone. And it’s been a long time since we had a new meme. So here’s one.

It’s simple. Just list all the jobs you’ve had in your life, in order. Don’t bust your brain: no durations or details are necessary, and feel free to omit anything that you feel might tend to incriminate you. I’m just curious. And when you’re done, tag another five bloggers you’re curious about.

Serendipitously, I mentioned in a comment just a couple of days ago that I have had a lot of interesting life experiences; but still hadn’t decided what I am going to be when I grow up. I’ll play. So far, I have tried:

- Lawn Mower

- Fishing Worm Breeder/Wholesaler

- Snow Shoveler

- Paper Boy

- Pig Farmer

- Pine Cone Gatherer

- Chicken Farmer

- Car Wash Attendant

- Farm Laborer

- Fruit Picker

- Almond Knocker (hardest job ever)

- Grease Monkey

- Grocery Box Boy

- Busboy

- Ice Cream Dipper (Thrifty Drugstore)

- Sales Clerk

- Radio/TV Repair

- Grocery Clerk

- U.S. Army Soldier

- Microwave Radio Repair

- Morse Code/RTTY Operator

- Waiter

- Bartender

- Bouncer

- Policeman

- Electronic Test Equipment Repair /Calibration

- Satellite Tracking Station Telemetry Technician

- Computer Engineer

- Computer Programmer

- Computer Designer

- Electrical Contractor

- Burglar Alarm Business (Seychelles Islands)

- Farm Manager (Rhodesia)

- 2-Way Radio Repair (Rhodesia)

- Quasi-mercenary (Rhodesia)

- Solar Energy Contractor

- Solar Collector Manufacturer

- Solar Collector Traveling Salesman

- Charter Boat Deckhand

- Commercial Fisherman (California)

- Newspaper Columnist

- Yacht Captain (Mexico)

- Tuna Boat Captain (Hawaii)

- Marine Electronics Business

- Fishing Magazine Columnist

- 2-Way Radio Business

- Cell Phone/Fax Machine Retailer

- PC Clone Manufacturer

- Computer Consultant

- FM Radio Station Engineer

- Cattle Rancher

- Retirement Care Facility for the Elderly

- Montessori Preschool

- Business Consultant

- Webmaster

- Ghost Writer

Many were entrepreneurial pursuits rather than jobs, so I just listed all the different ways in which I have earned money. I have lived in eight countries and sixteen States, so home is where my bunk is at any particular time. Several were repeated in new locales; but the list was already long enough, so I didn’t repeat the duplicates. I suspect I may have left a few out. 🙂

I tag all the other few bloggers who happen to read this. You know who you are, and I would be interested in reading your background. â—„Daveâ–º

Corporatism vs. Socialism

Corporatism vs. Socialism

David Boaz of the Cato Institute makes an interesting case:

Jonathan Cohn of the New Republic suggests that the federal government use its new power over the auto companies to fire a General Motors vice chairman who has expressed skepticism about the catastrophic effects of global warming, and congressional Democrats wanted to forbid the firms from filing lawsuits against state environmental regulations.

That’s corporatism for you: Big, established corporations get taxpayers’ money as long as any dissenting scientific or political opinions are suppressed.

Socialism is dead even in Moscow and Beijing.

The real choice Americans face is whether we want a free market or a corporate state.

He thinks Obama will increasingly support corporatism over socialism. I am skeptical, but he does seem rather pragmatic. I see his support of the auto industry more as supporting unions than corporations; but time will tell. â—„Daveâ–º

Hypocritical Hubris

Hypocritical Hubris

You knew this was coming, right? With economy in shambles, Congress gets a raise:

A crumbling economy, more than 2 million constituents who have lost their jobs this year, and congressional demands of CEOs to work for free did not convince lawmakers to freeze their own pay.

Instead, they will get a $4,700 pay increase, amounting to an additional $2.5 million that taxpayers will spend on congressional salaries, and watchdog groups are not happy about it.

“As lawmakers make a big show of forcing auto executives to accept just $1 a year in salary, they are quietly raiding the vault for their own personal gain,†said Daniel O’Connell, chairman of The Senior Citizens League (TSCL), a non-partisan group. “This money would be much better spent helping the millions of seniors who are living below the poverty line and struggling to keep their heat on this winter.â€

Hypocritical hubris at its finest. â—„Daveâ–º

SantaCorp

SantaCorp

SantaCorp Pleads Case For Bailout, from the IowaHawk, of course:

Kringle and UET union president Binky McGiggles presented a draft emergency bailout plan to the committee calling for US $18 trillion in federal grants, loan guarantees, and sugarplum gumdrops that they said would keep the company solvent through December 26.

“We believe this proposal shows that management and labor can work together to craft a reasonable, financially responsible short-term survival plan,” said McGiggles. “After the new Congress is seated in January, we would be happy to return to present a long-term package to get us through April.”

As usual, don’t miss the whole post if you enjoy satire. â—„Daveâ–º

The Real Obama

The Real Obama

Charles Krauthammer warns us not to be fooled by Obama’s foreign affairs cabinet picks. He is focused on domestic affairs:

As Obama revealingly said just last week, “This painful crisis also provides us with an opportunity to transform our economy to improve the lives of ordinary people.” Transformation is his mission. Crisis provides the opportunity. The election provides him the power.

The deepening recession creates the opportunity for federal intervention and government experimentation on a scale unseen since the New Deal. A Republican administration has already done the ideological groundwork with its unprecedented intervention, culminating in the forced partial nationalization of nine of the largest banks, the kind of stuff that happens in Peronist Argentina with a gun on the table. Additionally, Henry Paulson’s invention of the number $700 billion forever altered our perception of imaginable government expenditure. Twenty billion more for Citigroup? Lunch money.

Moreover, no one in Congress even pretends that spending should be pay as you go (i.e., new expenditures balanced by higher taxes or lower spending), as the Democrats disingenuously promised when they took over Congress last year. Even some conservative economists are urging stimulus (although structured far differently from Democratic proposals). And public opinion, demanding action, will buy any stimulus package of any size. The result: undreamed-of amounts of money at Obama’s disposal.

To meet the opportunity, Obama has the political power that comes from a smashing electoral victory. It not only gave him a personal mandate. It increased Democratic majorities in both houses, thereby demonstrating coattails and giving him clout. And by running on nothing much more than change and (often contradictory) hopes, he has given himself enormous freedom of action.

Obama was quite serious when he said he was going to change the world. And now he has a national crisis, a personal mandate, a pliant Congress, a desperate public — and, at his disposal, the greatest pot of money in galactic history. (I include here the extrasolar planets.)

Are you ready for a socialist paradise? â—„Daveâ–º

Bailout Print Paupers

Bailout Print Paupers

PJ O’Rourke’s plea, “Print paupers could use bailout” is great for a morning laugh while our very nature as a capitalist society is disintegrating before our unbelieving eyes:

Remember, America, you can’t wrap a fish in satellite radio or line the bottom of your birdcage with MSNBC (however appropriate that would be). It’s expensive to swat flies with a podcasting iPod. Newsboys tossing flat-screen monitors on to your porch will damage the wicker furniture. And a dog that’s trained to piddle on your high-speed internet connection can cause a dangerous electrical short-circuit and burn down your house.

Enjoy… if you still can laugh. â—„Daveâ–º

Riots and Inflation

Riots and Inflation

GOP Senator Warn of Riots if Automakers Are Bailed Out

In a remarkably candid interview, Sen. DeMint, R-SC makes some very good points:

“We’re going to have riots. There are already people rioting because they’re losing their jobs when everybody else is being bailed out. The fairness of it becomes more and more evident as we go along. The auto companies may be hurting,†he said, but “there are very few companies that aren’t hurting and they’re going to hurt. We don’t have enough money to bail everyone out.â€

“There is no question this will result in inflation,†DeMint said. “The amount of money we’ve borrowed, the amount of money we’ve printed has put us in a more dangerous situation than we’ve ever been in as a country. We may not see the inflation as long as the economy is slow. But, I’ve talked to some economic experts and once the economy starts picking up with so much money in the money supply and so much debt, we’re likely to see very high interest rates and very high inflation rates.â€

“If you look at where we’re going, we’re not on a sustainable course as a country,†DeMint said. “Frankly, GM is in a better financial situation than we are as a country. The only difference is we can print money. But as other countries around the world lose confidence in the value of a dollar – that’s going to come home very shortly.â€

I couldn’t agree more. Let’s just go ahead and get a Chapter 11 Judge to reorganize the Federal government, shall we? â—„Daveâ–º

Jump Start America

Jump Start America

I just received an e-mail from a friend who doesn’t often forward advocacy type e-mails, so I read it with interest. Personally, I don’t like the government bailing out anyone or any entity for any reason. However, pragmatically, they are already on that foolish path and as I understand it they are struggling for the best way to spend the $700B that they have already approved for the purpose.

The following is the most innovative idea I have seen, and it makes a lot of sense. It is from a local accountant that I have actually met at our Pismo Derelicts gathering, named Ken Fontes. Rumor has it that he has actually gotten some attention in Washington DC and may be interviewed by Hannity about it next week:

Family, Friends and Fellow American Taxpayers,

After weeks of listening to how our elected representatives plan to spend OUR 700+ Billion Dollars, I felt it was time for someone to come up with a solution that would help the majority of homeowners in this country, instead of just a select few. As each proposal was revealed, it became more and more apparent that only those homeowners that were either on the brink of financial collapse, or those that had plenty of equity in their homes, were going to benefit from this “bailout” money.

The company that I work for has a warehouse full of people, and I have a whole lot of family, friends and acquaintances that make their payments every month and never ask for a thing. When the interest rates started to come down last week, I asked many of them if they were going to refinance. They all said “No, because they owed more on their homes than their homes were worth”, and that no financial institution would touch their request, even with the bailout money. These hard working Americans all plan to continue making their payments, but due to falling home equities, they no longer meet the qualifications necessary to refinance their homes.

When I thought about the Great Depression and the TVA & WPA programs that were instituted in the 1930’s, I remembered hearing how people wanted “a hand-up, not a handout”. I believe that mainstream Americans are still like that, and a hand-up is exactly what the Jump Start America, (“JSA”) plan provides. Our Nation simply can not wait for the “experts” to try and figure out how to save our fragile economy.

Jump Start America:

- Will put discretionary income immediately into the pockets of working people who can get this economy rolling.

- Will recapitalize the banks so they can start lending again and continue funding the growth of Small Business America.

- Will increase State and Federal income tax revenues WITHOUT increasing current tax schedules.

Take a look at the attached Jump Start America plan and if you believe “JSA” will work for our country, please pass it on to everyone you know. Tell a neighbor, e-mail your family and friends, call the newspaper, contact your congressman and let’s all do what ever it takes to be heard. Who knows, the home you save may be your own!

Thank you for your help,

“Ken the Accountant”

December 5, 2008Jump Start America

“JSAâ€On January 1, 2009 all financial institutions currently holding first trust deed mortgages would send their borrowers a letter offering to change the terms of their loan, at no cost, to a 3%, 30 year, non transferable fixed loan. Unless the borrower chooses by return letter not to accept the offer, on February 1, 2009 each loan would be re-amortized with a new payment schedule based on the 3% fixed rate. The institution, (using a pre-established formula that takes into consideration the type of loan being replaced), would evaluate the loss in revenue caused by the restructure and would then apply for a lump sum reimbursement from the 700+ billion dollar bailout fund. The offer would be available to every person or corporation with a 1st trust deed on a residential property, anywhere in the USA, regardless of their current property value, financial responsibility, or payment status.

- For Americans. The “JSA†plan would provide immediate relief to all Americans that have a 1st Trust deed loan. For millions of hard working people “JSA†would replace high interest rate fixed loans, as well as low interest rate ARMs and interest only loans that are impending financial disaster for this country. The plan is not selective and would not only help those who are on the brink of losing their homes, but would also help those Americans who have faithfully worked hard and made their payments, but are struggling in these tough economic times. The lowering of payments to a large majority of Americans would “Jump Start†the economy immediately, with the lower payments not only saving many homes from foreclosure, but also putting discretionary income back into the pockets of people who would be purchasing goods and services in communities all across our country.

- For Financial Institutions. The “JSA†would immediately convert many “High Risk†and problem loans into solid, profitable, low risk loans. All past due principle and interest would be re-amortized into the new 3% fixed rate loans and all 1st trust deed loans would be current as of February 1st. Because of this, foreclosures on 1st trust deeds would cease immediately. The funds passed on to the banks for the interest shortfall would recapitalize these financial institutions who would in turn, “Jump Start†the economy by having funds available to borrowers for new home purchases, construction and consumer goods, as well as to businesses for much needed operating & capital funds.

- For The Government. The “JSA†would increase tax revenue without increasing taxes. With less interest being paid across America, the schedule A interest deduction would be reduced dramatically, therefore increasing income tax revenue for the 2009 tax year. This increase in tax revenue for the Federal and State government, without increasing current tax rate schedules is fair and equitable for all Americans. With the “JSAâ€, only those who benefit from the plan pay more income taxes, with those taxes being far less than the interest break benefit that they received from their new “JSA†fixed rate mortgage. The “JSA†would “Jump Start†the new administration with an immediate increase in income tax revenue for the programs promoted during the recent election.

Thoughts from Working Americans

- 1. Felipe P., Santa Maria, California. 37, married with 3 children. Felipe is a shipping supervisor with his wife working in banking. Current mortgage is at $400,000 on home purchased for $450,000. Home is currently valued at $290,000 with 3 year interest only loan, now due to be converted to fully amortized loan. If converted before “JSAâ€, mortgage payment will be at least $2,600 per month. Under the “JSA†plan monthly payment would be $1,675 per month. Felipe says, “I have been trying to convert my loan to an affordable fixed rate loan for the past year and a half. No lender will even consider my request because of the lack of equity in my home. If my payment goes to $2,600 per month, I will not be able to make the payment, and will likely have to give up my house and ruin my credit. This also means moving my family out of the area that we love. The “JSA†plan will allow me to keep my house and my credit.â€

- Penni C., Citrus Heights, California. 50, married, with 2 children. Both she and her husband are employed as x-ray technicians. 1st mortgage of $150,000 on home valued at $300,000. Loan is a 6.25% fixed loan with a payment of $925 per month. The “JSA†plan would reduce payment to $625 per month. Penni says, “To a lot of folks $300 per month doesn’t sound like a lot of money. But my husband and I have just finished putting one daughter through college and have another still attending. We have college debt, medical bills from some recent cancer treatments, and an old car that needs replacing. The $300 a month would allow us to make a payment on a new car that we would otherwise not be able to afford.â€

- Ron P., Clovis, California. 40, married, no children. Ron is an independent real estate appraiser with his wife working as an office manager in a construction company. Mortgage of $240,000 on home purchased for $300,000. Home is currently valued at $200,000 with 30 year fixed loan at 6.50%. Mortgage payment is currently $1,575 per month and would reduce to $1,050 under the “JSA†program. Ron says, “With the R/E sales falling to an all time low, my appraisal business is down to a quarter of what I did last year. I have had to take on a second job in order to make ends meet. If the “JSA†is implemented, not only would the $525 per month savings help us get back on our feet, the capital infusion to the banks would likely get the real estate market back in gear, which would bring back new appraisals to my business.â€

- Rita Z., Nipomo, California. 30, married, no children. Rita is a sales manager with her husband working as an operations manager. Home was purchased for $365,000 with no money down at 7.25% fixed. Home is currently valued at $290,000 with a payment of $2,550 per month. New payment under JSA plan would be $1,575 per month. Payment would decrease by $975 per month. Rita says, “We have been watching the decline in interest rates and were initially hopeful of refinancing our home. But after a few calls we realized that without equity in our home, no one would even talk to us. We can, and will, continue to make the payment on our home, as long as both my husband and I remain employed. If the “JSA†plan were implemented, we would likely be able to start a family, which at this point is impossible to even dream about.â€

“Ken the Accountantâ€

Ken has put some common sense thinking into this, something that seems in short supply in DC. I reckon it is worth getting behind the idea, since they are going to just give the money to banks anyway. Any discussion? â—„Daveâ–º

Local Currency

Local Currency

Here we go. “Milwaukee neighborhoods could print own money” :

Residents from the Milwaukee neighborhoods of Riverwest and East Side are scheduled to meet Wednesday to discuss printing their own money. The idea is that the local cash could be used at neighborhood stores and businesses, thus encouraging local spending. The result, supporters hope, would be a bustling local economy, even as the rest of the nation deals with a recession…

It’s not a new concept—experts estimate there are at least 2,000 local currencies all over the world—but it is a practice that tends to burgeon during economic downturns. During the Great Depression, scores of communities relied on their own currencies.

And it’s completely legal…

I sure hope this catches fire. â—„Daveâ–º