Best Advice Yet

Best Advice Yet

I enjoyed reading an “Exclusive Interview With Diapason’s Sean Corrigan” about the world economy, which I highly recommend for the insights provided. Then, near the end, his answer to the following question was so profound that I wanted to memorialize it here for future reference:

We here at Zero Hedge are labelled as fringe lunatics who thrive on bad news. We only take issue with this to the extent that the label allows “others†to dismiss us out of hand, while not debating us on the merits of our ideas and opinions. Central to our platform is the debunking of generally accepted conclusions of mainstream Wall Street Economist and Strategists. We do so, not only because it is sometimes fun, but because we want to encourage our readers and ourselves to think beyond what we are all being spoon fed. We are interested in what advice you would give a 25 year old graduating from University about the future. How should they think about money, how should they be investing, and what do you think their future will look like (10 year time horizon) in a developed nation? Would you give different advice to a 25 year old in an emerging nation?

Answer: The first thing I would say is that, from direct personal experience, he should not even begin to imagine that he has completed his education , just because he has been awarded his degree!

If he (I’m sufficiently advanced enough beyond the age of 25 to luxuriate in the presumption that ‘he’ is a non-gender specific pronoun in this context) is lucky enough, his university will not just have shepherded him though a few exams, but will have encouraged him to learn how to think for himself and to trust his judgement when he applies that ability rigorously enough.

If he has been astute enough, he will also have realised that he needs to be equipped with a few basic tools beyond his specific expertise in order to navigate his way through the sea of half-truths and lazy presuppositions which are likely to surround him.

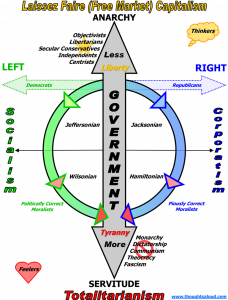

Firstly, he needs basic numeracy skills so he can have a sense of magnitudes, costs, and probabilities. Secondly, he needs a sense of geography so he knows where he is and a sense of history so he knows when and who he is. Thirdly, he needs to be able to both understand an argument and to make one, so that he can spot the falsehoods he is constantly being sold (sometimes, it has to be said, wholly inadvertently) and so that he can make his own case in response, once he has framed it. Finally, he needs to realise that the state is a wolf, not a sheepdog and that his liberty and right to self-expression are much more at risk from the smiling, ballet-box tyrants at home than it ever is from the foaming-mouthed, comic opera dictators whom he is enjoined to hate abroad.

He should realise that money is a medium by which wealth is exchanged, it is not wealth itself, much like it is the information he trades over the web which is important, not the plumbing of routers and servers and cabling which transmits it.

He should also be aware that when it comes to matters of money and economics, most of the ostensibly-learned discussants are sadly espousing ideas no more advanced or well-founded than were those of sixteenth century alchemists and leeches in the science of metallurgy or medicine.

Let’s start with the fact that ‘investing’ is one of those undertakings which is simple in concept but very difficult of execution and that it requires effort.

Furthermore, it is a very distinct activity from trading. One may have a great deal of fun – and even make a very nice living – trading, once one understands that trading is as little about the ‘fundamentals’ of economies or businesses being traded as poker is about the specific cards one draws in a hand. But he should also know that investing is a longer game where the idea is to buy something valuable to which the market has temporarily attached too low a price, that the market often does exactly that – and hence that the classic ideas of ‘efficiency’ and ‘rationality’ are an exploitable artefact of academic vanity.

He should know, ultimately, that only entrepreneurs create wealth and that, short of being an entrepreneur himself, he should look for market-given opportunities to invest in other men and women who are, when he can do so at what he reckons is a discount to their likely potential to generate income. He should always bear in mind that genuine entrepreneurs are THE ‘active managers’, THE ‘generators of alpha’ to whom he needs to entrust his hard-earned money above all others.

I’m not sure I would presume to offer any different advice to a young man from the developing, as opposed to the developed world, except to urge that he pay lots of attention to what might be lucrative gaps between what goes on in his country and what we in the West do in ours and also that he resolves to learn not just from what we do well, but from what we do badly! As for the call to indulge in futurology, that really is a fool’s game. Life moves too fast to be overly specific. In a Heraclitan universe of flux, the straight edge with which one extrapolates an existing trend is the most dangerous instrument in one’s tool kit.

All I can say is that, despite the age-old Malthusian pessimism which is currently enjoying such a vogue, I doubt we will run out of energy – or any other service provided by a material resource – on any foreseeable horizon, though politics and the cult of Gaia might make it seem that way. While I am resolutely despairing of the ability of or the incentive for politicians to make the right choices on any kind of consistent basis, but I am also quietly optimistic of the ability of the man in the street to find his way around the obstacles their incompetence and venality erect in front of him.

Not that I am all that confident that a sophisticated future awaits today’s 25-year-olds; but if perchance we somehow survive the suicide mission Western society is presently embarked upon, this would be sage advice to follow. â—„Daveâ–º

Very good advice to which I would add only one thing… move to New Zealand. it may practice a bit of socialism, but it hardly seems on the high road to dictatorship.

Troy

I wholeheartedly agree! Kiwis are good people. If I were a younger man, I would be out of here! The alternative is to mentally go Galt, and try to ignore the insanity that is going on around one. Imagine the bliss of all the clueless sheeple who have no idea what is coming. I have finished Buchanann’s “Suicide of a Superpower” and am in the middle of Mark Steyn’s “After America.” We are so screwed! It is an absolute waste of what precious time we have left in life, to try to save this country. In the end, nothing we could accomplish now will matter a whit; because demographically we are a rapidly dying culture. I am in a serious process of reevaluating what I should be expending my mental energy on besides politics… â—„Daveâ–º